Your charitable contribution to the IFFD Foundation is much more than just a donation. Your commitment contributes to an effective approach which is strengthening families all over the world as well as promoting the family perspective in the agendas of international organisations and in the policies of many governments.

How to make a donation?

We appreciate all your support

[contact-form-7 404 "Not Found"]

To make a donation by wire transfer:

Please, fill in the form below and send to comunicacion@iffdfoundation.org, before ordering the transfer. Then, take note of the data to order it.

Bank: Banco Caminos, C/ Almagro 8,

28010 Madrid

Beneficiary: IFFD Foundation

Address: Calle Artistas nº 2, 2º 28020 – MADRID

IBAN: ES69 0234 0001 04 9030952715

BIC (SWIFT): CCOCESMMXXX

Concept: IFFD Foundation Donation

Address Beneficiary IFFD Foundation

Calle Artistas nº 2, 2º 28020 – MADRID

Tax ID number: G82662669

For every transfer, it is VERY IMPORTANT that you send an email

to comunicacion@iffdfoundation.org with the following information: Date of the transfer, Amount and currency of the transfer and the Name and Address of the Donor (for the official record).

to comunicacion@iffdfoundation.org with the following information: Date of the transfer, Amount and currency of the transfer and the Name and Address of the Donor (for the official record).

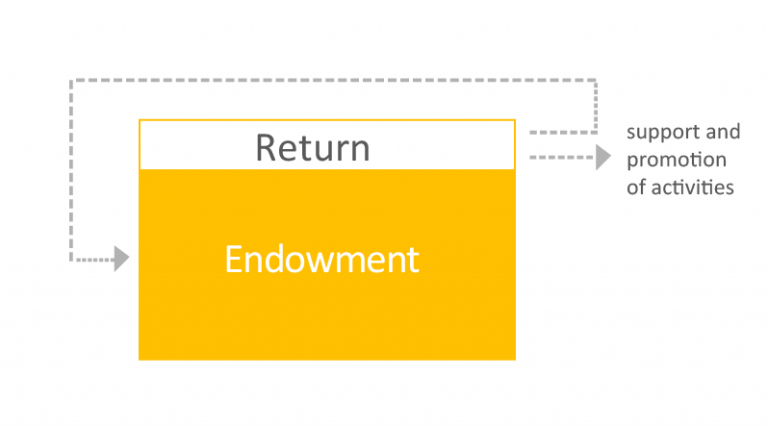

Endowment fund

The objective is to create an endowment fund whose return will provide the necessary economic stability to the activities promoted by IFFD, and at the same time will make possible the plans for growth and expansion that that IFFD is promoting.

THE MONEY OF THE ENDOWMENT FUND

is invested in vehicles which are specialised in the management of this type of funds. The objective of investment is to obtain a growth of capital in the short to long term by investing in a diversified asset portfolio.