THE OBJECTIVE

is to reach $20 million by 2028. As of June 2024 the value of the endowment fund is $5.4M.

is to reach $20 million by 2028. As of June 2024 the value of the endowment fund is $5.4M.

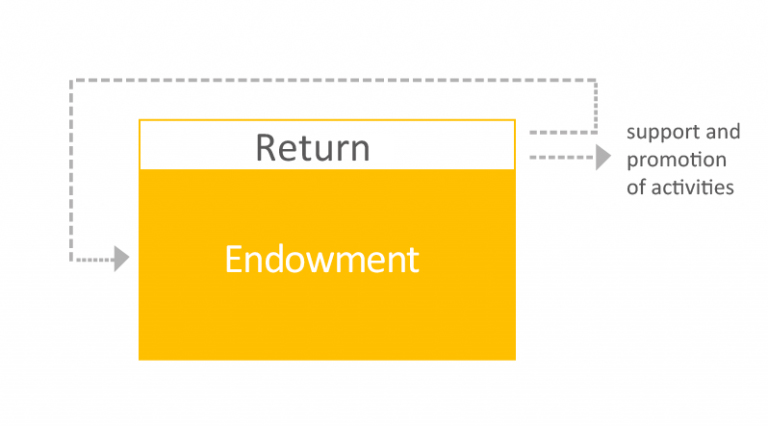

is managed according to an endowment policy approved by the IFFD Foundation Board of Trustees.

The money is invested in vehicles that are specialized in the management of this type of funds.

Chairman. CFA, Manager of a family office

Professor of Finance (IESE Business School)

General Manager of GVC Gaesco Gestión

Director at Stelac Advisory Services

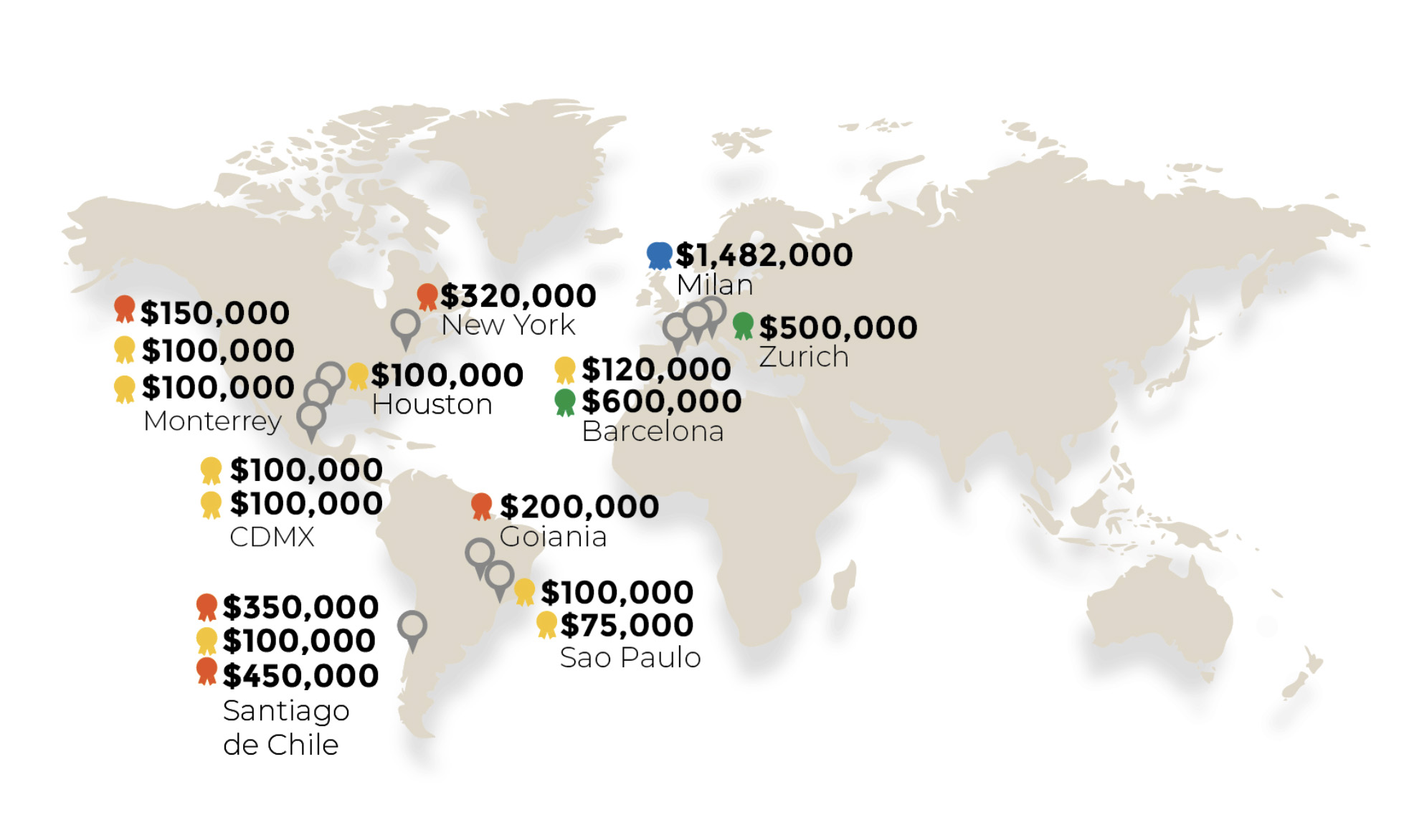

(*) Some of these grants are multi-year commitments that have not yet been disbursed in its entirety.